In a prior post, I discussed the possibility of downgrading my American Express Premier Rewards Gold card to a no-annual-fee Blue card right before the Gold card’s $175 annual fee — which was waived for the first year — hits my account. Yesterday, I found out that that isn’t as good of an idea as I had thought because Membership Rewards points held in a Blue card account are not eligible to be transferred to American Express’s airline and hotel transfer partners (which is the best way to redeem MR points).

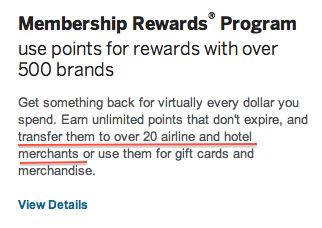

I have never actually held a Blue card, but while researching the prior post, I came across this seemingly clear-cut statement right on the application landing page for the Blue card:

Yesterday, I placed a call to American Express to try to get to the bottom of this. I first confirmed that not all “Membership Rewards” points are alike, and that points tied to a Blue account were in fact ineligible for transfer to partner airlines and hotels. I then asked why the application page for the Blue card states that Membership Rewards points earned on the card can be transferred “to over 20 airline and hotel merchants.” The representative — I didn’t get her name, but she sounded like Marta from Arrested Development so let’s call her that — seemed surprised that I appeared to be quoting the American Express website, so she navigated to the page herself to verify. And then, to my great surprise, instead of stalling, reverting to a talking point, or asking me to hold, Marta candidly admitted: “Wow, it really shouldn’t say that. That’s not true at all.” She then told me that she would escalate the issue and try to get the error corrected.

Yesterday, I placed a call to American Express to try to get to the bottom of this. I first confirmed that not all “Membership Rewards” points are alike, and that points tied to a Blue account were in fact ineligible for transfer to partner airlines and hotels. I then asked why the application page for the Blue card states that Membership Rewards points earned on the card can be transferred “to over 20 airline and hotel merchants.” The representative — I didn’t get her name, but she sounded like Marta from Arrested Development so let’s call her that — seemed surprised that I appeared to be quoting the American Express website, so she navigated to the page herself to verify. And then, to my great surprise, instead of stalling, reverting to a talking point, or asking me to hold, Marta candidly admitted: “Wow, it really shouldn’t say that. That’s not true at all.” She then told me that she would escalate the issue and try to get the error corrected.

And then I did what I always do when I develop any sort of rapport with a customer service representative: I asked for free stuff. I’m really shameless too. It went something like “So, any chance I could score some points for bringing this to your attention?” Marta responded, “let me see what I can do,” and five seconds later reported: “Oh great, it’s letting me add 7,500 points to your account!” I was floored. I expected 500, maybe 1,000 points as a courtesy, but 7,500 points really made my day — I value those points at about $115! I also found her choice of words interesting: “It’s letting me add 7,500 points to your account.” American Express must have some sort of customer-specific, computer-generated number of points that its agents are permitted to provide as a courtesy (though I’m sure the system tracks these courtesies to prevent repeat requests). In any event, before we had even ended the call, the 7,500 points had already hit my account.

So what is the best technique for avoiding an American Express annual fee? For starters, it couldn’t hurt to call customer service and ask very nicely for the fee to be waived. My father actually believes that he holds the world record for most consecutive successes in this regard. Barring success on that front, there are a few decent but not perfect solution.

First, you could transfer all of your points to an airline or hotel loyalty program before the annual fee hits, and then cancel the card. The problem with this approach is that your forfeit the flexibility of your points, and lock yourself into a particular loyalty program. Alternatively, you could downgrade to a green card and keep your full-fledged, transferable points in tact. This certainly does the trick, but it only saves you $80 (the difference between gold and green annual fees) and you’ll lose out on the ability to earn double and triple points in bonus categories. A third option is downgrading to the Blue card as I originally suggested. It isn’t the worst idea in the world — because doing so will preserve your points, and those points can be converted back into regular, transferable Membership Rewards points if you subsequently apply for a green, gold, or platinum card — but it’s far from ideal. Plus, unlike a downgrade to a green card, this approach requires you have to apply for a new card and incur a hard credit inquiry in order to restore your points to their full potential. The flipside of that concern, however, is that you could potentially earn another signup bonus (if you haven’t applied for the same product within 1 year, or another consumer Membership Rewards card within 90 days), so it may be worth the tradeoff.

Pingback: website design()

Pingback: SEO VPS Review()

Pingback: szkolenia kraków()

Pingback: wolnostojące()

Pingback: צמיגים()