Most of my favorite credit cards have annual fees. The real top-tier credit cards deliver enough value to justify their annual fees several times over — by way of signup bonuses, rewards for spending (points, miles, or cash), and non-spending-related perks (like free checked bags with an airline credit card). That said, everyone should have at least one credit card with no annual fee because these cards are great tools for building a strong credit score.

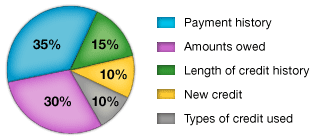

As I described more fully in a prior post, 15% of your credit score is attributable to the average length of your credit history. Old credit cards increase the average length of your credit history and thus positively impact your credit score; new credit cards have the opposite effect.

The problem with annual-fee cards is that they become very expensive to maintain over the long run, and the competitive landscape of the credit card business makes it unlikely that many cards will be worth their annual fee ten, fifteen, or twenty years down the road. At the moment, I’d contend that the Chase Sapphire Preferred card is the best card on the market. But a few years from now, it’s highly likely that another card will eclipse the Sapphire Preferred card. The new card might offer a more generous return, or Chase might change the point-earning structure of the Sapphire Preferred card, or Ultimate Rewards points might be devalued through the loss of transfer partners. There are lots of possibilities, and of course they’re all rank speculation at this point, but I can think of only one credit card – the American Express Starwood Preferred Guest card – that has remained dominant for more than a decade, and even that star is beginning to fade. When an old card with an annual fee loses its luster, the cardholder is left with a Catch 22 – continue to pay for a card that no longer delivers much (or any) value, or cancel the card and lose a valuable asset on your credit report.

Cards that carry no annual fee, on the other hand, cost nothing to maintain, so you can and should keep them open forever and ever until the end of time. If your card becomes less valuable than it once was, by all means find a better alternative but do not close the account. There’s no harm or cost to maintaining the account, and that seemingly useless credit card will mature into a huge asset on your credit report over time. The important thing is to start the clock running on your credit history as early as possible, and to do so with a credit card that you can afford to keep on your credit report forever.

So what are the best no-annual-fee credit cards?

This is by no means an exhaustive list, but here are some of the best options:

The Fidelity Investment Awards American Express card is an excellent choice that offers 2% cash back on all purchases, but requires you to create a Fidelity deposit or brokerage account.

The American Express Blue Cash Everyday card is another good option: it offers a signup bonus of $100 after you spend $1,000 within three months, and earns 3% cash back at supermarkets on up to $6,000 of purchases each year (1% thereafter), 2% cash back at gas stations and certain department stores, and 1% cash back on all other purchases.

I also like the Chase Freedom card, which offers a $100 signup bonus after you spend $500 within 3 months, and earns 5% cash back on three rotating categories per quarter and 1% cash back on all other purchases.

The Hilton HHonors American Express card isn’t a great card to use, but simply holding it confers Hilton Silver status, so that’s something. (And by something, I mean two bottles of water and a few other unimpressive perks).

I only use referral links if they direct you to the best offer for each card, but please note that the Blue Cash Everyday card referral link also generates a commission for me if you are approved through it! Likewise, if you plan to apply for the Chase Freedom card, I’d greatly appreciate it if you’d consider applying through this creditcards.com Reward Credit Cards link (click to page 2), which will earn me a commission if you are approved.