I apply for approximately 4-6 credit cards per year, which seems crazy, or at least very irresponsible, to most people. I keep some of the cards for long-term use, but apply for others for the sole purpose of obtaining a hefty signup bonus. For this latter category, I meet the minimum spend threshold required to trigger the signup bonus, collect a huge chunk of points or miles, and then place the card on my dresser and let it collect dust for about 10 or 11 months. There’s no magic to that time period, but the two parameters to keep in mind are: (1) some issuers reserve the right to claw back a signup bonus if a card is cancelled within six months (for example, on the Chase United Explorer card), and even though I’d be surprised if that right was ever exercised, I prefer to avoid the possibility altogether, and (2) obviously, if you don’t plan to use the card in the future, it makes sense to cancel the card before you’re hit with an annual fee.

When I tell people about this practice, the response that invariably follows is: “Aren’t all of those credit card applications killing your credit score?” The answer, to most people’s surprise, is that my credit score has actually increased — significantly — since I began taking advantage of these lucrative credit card offers with more regularity.

By way of background, there are three major credit reporting agencies in the United States — Equifax, Experian, and TranUnion — and each agency calculates an individual’s “FICO” score independently. All three scores are referred to as “FICO” scores because each agency calculates its score based upon software developed by Fair Isaac and Company (“FICO”), but the scores can and do vary based upon the information available to each agency at the time of a particular credit inquiry. (For more information on the disparity between FICO scores, click here).

When I began to apply for credit cards more aggressively, I waded into the process very cautiously. I applied for one card at a time and then vigilantly monitored each application’s impact on my credit score.

On that note, there are two great tools for monitoring your credit score for free: Credit Sesame, which provides your Experian FICO score, and Credit Karma, which provides your TransUnion FICO score. These are not trial-period, cancellation-required gimmicks like “FreeCreditScore.com”; both are actually free, reputable resources that I use and highly recommend. I am not aware of any free way to obtain Equifax FICO scores.

As my credit scores seemed unaffected by each application, and in fact continued to rise notwithstanding each application, I began to research how credit scores are calculated. The actual formula for determining FICO scores is — not surprisingly, I suppose — proprietary, but FICO provides enough information on its website to permit some fairly educated guesses as to why my credit score has risen over the past few years.

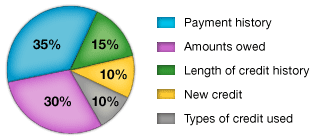

The most important piece of information is the appropriately-titled “How a FICO Score breaks down” chart:

This chart, and the explanations that accompany it (here), provide a great deal of information about the impact of a credit card application on a person’s FICO scores.

I draw three important inferences from this chart and the explanations that accompany each category.

First, the most important consideration – payment history (35%) – is unaffected by the presence or absence of new credit inquiries. The payment history component simply measures whether you have paid your past credit accounts on time.

Second, the second-most important consideration – amounts owed (30%) – is actually positively impacted by new credit card approvals because new credit card approvals increase a person’s amount of available credit and thereby decrease the percentage of available credit that is actually used. As FICO explains:

[W]hen a high percentage of a person’s available credit is been used, this can indicate that a person is overextended, and is more likely to make late or missed payments.

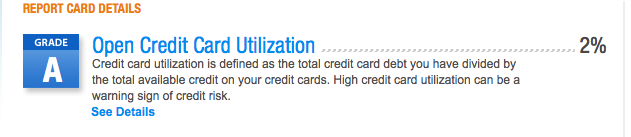

I suspect that this factor has played a large part in my own rising credit score. Before I started applying for credit cards with some regularity, I only had two credit cards with a combined credit limit of $12,000, so I would use somewhere between 20% and 50% of my available credit each month. As I applied for additional cards, my available credit doubled, then tripled, and is now about ten times higher than it used to be, so I now use between 2% and 5% of my available credit in a given month. According to Credit Karma, this factor is of “HIGH” importance, and any person using between 1 and 20% of his/her available credit receives an “A” in Credit Karma’s informal grading system.

Third, only a combined 25% of a person’s credit score — length of credit history (15%) and new credit (10%) — is negatively impacted by new credit card approvals. Twenty-five percent of such an important number is certainly significant, but these two factors account for much less of a person’s credit score than I had expected.

The “length of credit history” component of a FICO score is adversely affected by new credit cards because each new credit card brings down the average length of a person’s outstanding credit relationships. To that end, longstanding credit card accounts should never be cancelled (unless they carry large annual fees), and, by the same token, cancelling new credit cards will increase the average length of a person’s credit history and may have a positive net impact on one’s credit score, depending on whether and to what extent the increase in average length of credit history is offset by a decrease in available credit (some issuers, like Chase, will let you shift credit from the soon-to-be-cancelled card to another card of that issuer and thereby avoid a decrease in available credit entirely).

The “new credit” component of a FICO score is also adversely impacted by new credit card applications because, according to FICO, “[r]esearch shows that opening several credit accounts in a short period of time represents a greater risk – especially for people who don’t have a long credit history.” However, FICO also notes that:

The impact from applying for credit will vary from person to person based on their unique credit histories. In general, credit inquiries have a small impact on one’s FICO score. For most people, one additional credit inquiry will take less than five points off their FICO score. For perspective, the full range for FICO scores is 300-850.

. . .

While inquiries often can play a part in assessing risk, they play a minor part. Much more important factors for your score are how timely you pay your bills and your overall debt burden as indicated on your credit report.

So, to answer the question that I mentioned at the outset of this post – no, my credit card applications are not killing my credit score. My scores tend to take a 2-5 point hit for each new credit card application (I just applied for two new credit cards at the end of December and took 5 and 8-point hits on my Experian and TransUnions FICO scores, respectively), and they recover within 1-3 months, as old credit inquiries expire (they are only relevant for 12 months) and my average credit length history increases (since I cancel recently-acquired cards nearly as frequently as I apply for new ones, my average credit length history edges up as time passes). So long as I’m sitting comfortably above 740, which is generally considered to be the threshold for an “excellent” score, at which a borrower will be offered a lender’s best interest rate (e.g., for a mortgage loan), I’m happy to selectively take advantage of the best credit card offers available.

I am not, by any means, an expert in the calculation of credit scores, nor have I received any specialized training in this field. This post is based upon my interpretation of publicly-available information (mostly from myfico.com, the consumer division of Fair Isaac and Company (“FICO”)) and my own experiences. Please keep in mind that credit scores are individualized assessments of credit-worthiness; the fact that my credit score has increased despite semi-regular credit inquiries does NOT mean that this result is universal or even typical. I do not intend to suggest a positive correlation between credit card applications/approvals and credit score, or that applying for credit cards tends to increase a person’s credit score as a general matter.