Different people look for different things in checking accounts, but my primary objectives are to: (1) never pay monthly maintenance fees; (2) never pay ATM fees; and (3) earn a non-negligible rate of interest. With those goals in mind, I use Ally Bank as my primary checking account (in combination with an Ally savings account, as I’ll discuss in more detail below).

Side note: Before Ally, I used the Charles Schwab “High Yield Investor Checking Account,” which is a great checking product that offers many of the consumer-friendly features that Ally does, except that its “high-yield” interest rate has — ironically — shrunk to 0.15% over the years. The Fidelity Cash Management account is another similar product, but earns a measly 0.07%.

Of course, other people may place more importance on other factors — like the ability to walk into a brick-and-mortar branch and make a deposit, which is especially important for people in cash-oriented businesses — and for those people, an online checking account like Ally may not be the best option (though you could always do what I did before the days of mobile check deposit: open a basic account at a traditional bank, use that account for deposits, and then funnel the money to Ally).

But in my view, Ally bests the competition for the several reasons:

1) Interest rate. Ally’s interest rate is 0.40% for balances up to $15,000, or 0.75% for balances of $15,000 or more. This is an excellent interest rate in today’s ultra-low interest rate environment, and you can actually do better – 0.90% 0.84% on all balances – by opening a savings account in conjunction with your checking account. More on this later.

2) No ATM fees. Ally doesn’t charge ATM fees, and, more importantly, reimburses for all ATM fees charged by other banks. This feature is absolutely critical for an online checking account.

3) Mobile check deposit. Mobile check deposit (the ability to deposit checks by taking pictures of them with your phone) is a great feature as a general matter, but it’s particularly important for online checking accounts, given the absence of physical branches at which to deposit checks.

4) No hoops to jump through for advertised rates/features. Unlike many otherwise competitive online checking accounts, customers need not set up direct deposit or use their debit card a certain number of times in each billing cycle to avoid monthly maintenance fees, to be reimbursed for ATM fees, or to be eligible for the advertised interest rate.

5) No monthly maintenance fees.

6) No account minimums.

7) Free checks and online bill pay.

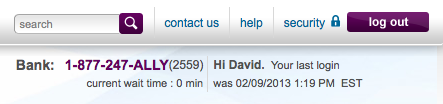

8) When you call, a human picks up. And there’s usually no wait to speak to a customer service representative. I know this because the website actually lists the wait time, if any, for their customer service line.

9) Very reasonable, clear-cut fees for services that all banks charge for. Ally’s fees are listed here.

As mentioned above, I opened a savings account in conjunction with my checking account, and would highly recommend this approach because the savings account currently earns 0.90% 0.84% APY, and transfers between an Ally checking account and an Ally savings account occur instantly. So I keep most of my uninvested money in my savings account to earn the higher interest rate, and transfer it – instantly – to my checking account as needed. Please note that – pursuant to federal law, apparently – only six withdrawals and transfers (in the aggregate) are permitted from a savings account per month before an “excessive transaction fee” of $10/transaction kicks in. This limitation does not bother me, as I move money between accounts much less frequently than 6 times per month.

So that’s why I use and highly recommend Ally Bank checking and savings accounts. Are there any better deals out there? If so, please discuss them in the comments!