Business credit cards offer some of the most enticing points-earning schemes and signup bonuses, but most people know very little about these cards or whether they qualify for one. Part I of this three-part series examines the eligibility requirements for business cards; Part II will discuss the significant but little-known differences between business and personal credit cards; and Part III will highlight my favorite business credit cards.

Determining whether a person qualifies for a business credit card can be a bit tricky, but there are only two major eligibility requirements that differentiate business credit cards from personal credit cards.

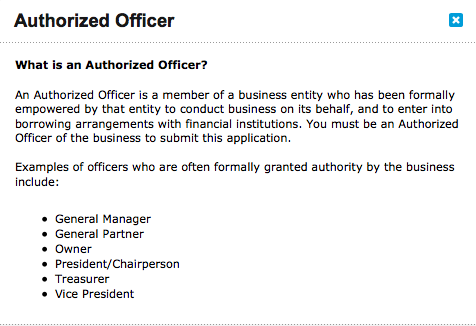

The first is that an applicant for a business credit card must be an “authorized officer” of a company, which essentially means that the applicant has the legal authority to bind the company to the terms of the credit card agreement. Citi, for instance, defines an “authorized officer” as a “member of a business entity who has been formally empowered by that entity to conduct business on its behalf, and to enter into borrowing arrangements with financial institutions.”

While becoming an “authorized officer” of some companies – namely, those with multiple owners – may require some legal formality, becoming an authorized officer of a sole proprietorship requires no formality whatsoever. A sole proprietor, as the sole owner of a company, is an “authorized officer,” and he or she may simply input his/her social security number as the business’s tax identification number on a business card application.

Note: The informal nature of a sole proprietorship has led many fellow bloggers to encourage consumers who would otherwise be ineligible for a business credit card to “think creatively” and consider whether they have any “side businesses” or plans for future businesses. The most common suggestion I’ve seen is usually phrased in the form of a question: “Have you ever sold anything on eBay?” I do not recommend conjuring up businesses (or potential businesses) in an attempt to qualify for a business credit card. It skirts a little to close to fraud for my taste. Plus, I’m a terrible liar, and if I wasn’t approved instantly, I’d have trouble convincing a “credit specialist” that my company was creditworthy.

Second – and this is not technically an eligibility requirement but it is sufficiently related that I think it bears mentioning – the terms and conditions of business credit card agreements typically require the applicant to represent that the card will be used exclusively for “business” purposes. A few examples of the types of representations contained within business card applications are:

- American Express: “By submitting this application, you, as an individual and the Authorizing Officer of the Company . . . are REPRESENTING THAT ALL CARD(S) ISSUED ON THE ACCOUNT WILL ONLY BE USED FOR COMMERCIAL OR BUSINESS PURPOSES.”

- Chase: “I agree this is a business account and shall only be used for business purposes and not for personal, family or household use.”

- Citi: “The Account established and Cards issued hereunder shall be used for business purposes . . . .”

This requirement is rarely, if ever, enforced. Can you imagine the amount of time and effort that it would take to police the usage of business credit cards, and then prove that a particular usage was for personal, rather than business, purposes? I’ll confess than I have not strictly complied with this requirement on my American Express Business Gold Rewards or Ink Bold cards. For some reason – perhaps it’s because I assume that very, very few business cards are used exclusively for business purposes – this type of infraction strikes me as less sinister than reclassifying a sale of an iPod on eBay as a “business,” but I’ll concede that the distinction is somewhat arbitrary.

That’s it for eligibility requirements; stay tuned for Parts II and III of this series, which will discuss the differences between business and personal credit cards (aside from eligibility requirements) and highlight my favorite business credit cards.

Pingback: Points on the Dollar - 75,000-Mile Bonus On The Business Gold Rewards Card from American Express OPEN!()