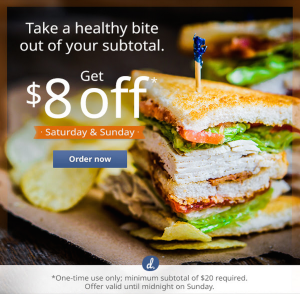

This one falls squarely into the category of not-going-to-make-you-rich-but-certainly-doesn’t-hurt: delivery.com is trying so hard to compete with Seamless/GrubHub that it’s apparently willing to give away $8 or more each week to lure customers to its online-ordering platform.

There’s no real magic, or even difficulty, here — just sign up for a delivery.com account, accept marketing emails (they only send one to two per week), and, like clockwork, each Saturday you’ll receive an email with a link for $8 off any order of $20 or more placed that weekend. I have no idea how long this marketing campaign will continue, but it has been going strong for nearly a year already: I started receiving the promotional emails back in December of 2013.

Oh, and please excuse the shameless referral plug, but if you sign up through this link, we’ll both get $7 once you place your first order.

Unfortunately for delivery.com, the campaign hasn’t actually shifted my non-discounted orders away from Seamless, and it probably shouldn’t change your habits either. The primary reason that I stay loyal to Seamless is that Seamless transactions are coded as restaurant spend whereas delivery.com purchases are codes as “Misc. Personal Services,” so I’m able to take advantage of the restaurant/dining bonus category and earn extra rewards with cards that offer bonuses on these types of purchases. At the moment, I’m earning 5% cash back on these purchases, but the Chase Sapphire Preferred card has been the mainstay of my Seamless account. The other, less significant reasons I remain a Seamless loyalist is that Seamless has a better interface and slightly more participating restaurants.

Interestingly, delivery.com has its own rewards program, but it isn’t lucrative enough to compensate for the inability to capture extra credit card rewards for bonused purchases through Seamless. The delivery.com program is unnecessarily complicated, but suffice it to say that, at the very best, it yields about 1.47 cents of delivery.com credit per dollar spent (and, significantly, no points are earned on tax or tip); I can do better exploiting restaurant/dining bonus categories through Seamless.

Bottom line? If you’re the type of person who occasionally spends more than $20 ordering food delivery on the weekends, you might as well create a delivery.com account and save $8 every now and then.